Property, and Hospitality Industries Boost Advertisement Expenditure to KSh. 18 billion.

Over the three months ending in June 2024, advertising expenditures in the media industry increased to Ksh18 billion from Ksh16 billion, thanks to advertisements from the property, building, and hospitality industries.

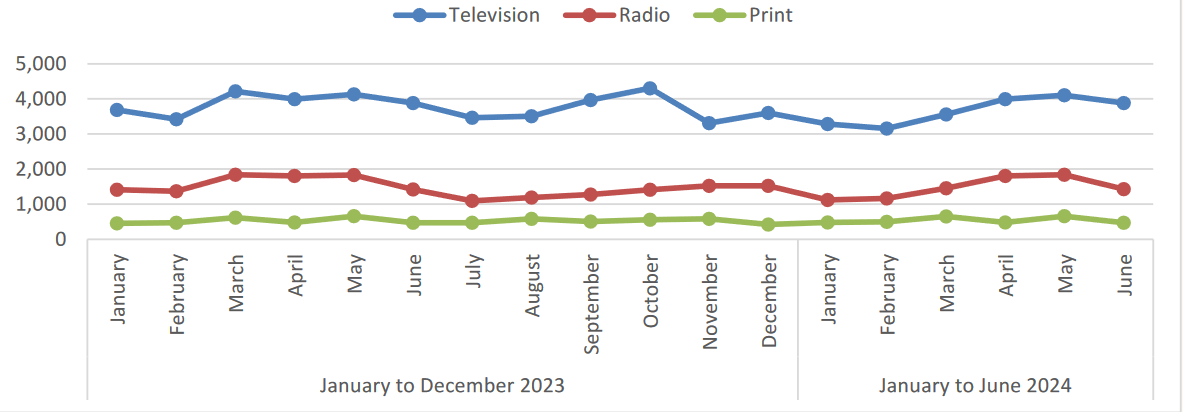

The Quarter 4 Audience Measurement and Industry Trends report by the Communications Authority of Kenya indicates that TV has the greatest spending, with radio coming in second. The report also notes that the predominant allocation of advertising spending is directed towards free-to-air TV, highlighting its central role in the advertising landscape. This emphasis on free-to-air TV underscores its effectiveness in reaching a wide and diverse audience.

“By the fourth quarter of 2023/24, spending surged to Kes 18 billion, with the greatest growth seen in the property, building, and accommodation sectors,” reads part of the report. Despite tough economic times, fast moving consumer goods (FMCG) and service brands remain strong, as the government reduced media buying.

On media consumption, the report indicates that there was an increase in daily TV consumption to 54 percent in Q4 2023/24, up from 52 percent in Q3 2023/24. In contrast, radio consumption saw a slight decrease to 51 percent in Q4 2023/24.

During the same period, daily participation in social media decreased from 47 percent to 45 percent. Among different demographic groups, males exhibit a greater preference for radio compared to females, with this trend being more evident among older individuals. Moreover, radio listenership shows a steady increase as age advances.

Radio consumption is most prevalent in the South Nyanza and Upper Eastern regions, while the Northeastern region shows the lowest rates of usage. Swahili is the language most of the stations are tuned into, followed by vernacular. This was observed across male and female listeners in all quarters.

Even though Swahili stations are the most tuned-in stations, English stations are used more in rural areas than in urban areas. This was observed only from Q3 2023/24 to Q4 2023/24.

The data reveals gender gaps in TV watching, as males demonstrate greater interest across the four quarters. There is a decrease in viewership among 15 to 17 year-olds, which indicates TV networks and streaming services are producing less content targeted specifically at teenagers, ignoring their interests and concerns. This may discourage more teens from watching TV, despite their academic responsibilities.

The Central region leads in TV viewership, with Nairobi and the Upper East following closely behind. In contrast, the lower eastern regions have the lowest TV viewership. These geographic differences in TV consumption highlight the need for customized media strategies tailored to specific regions.

In Kenya, free-to-air (FTA) TV has a significantly larger viewership compared to pay TV. The reach of both Pay TV and FTA TV is consistent across genders. However, Pay TV has a slightly higher reach among individuals aged 18 to 24 years, compared to older age groups.

Facebook and WhatsApp stand out as the top social media platforms in Kenya. Following closely in popularity, TikTok and YouTube secure the third and fourth positions, respectively. The prevalence of Facebook and WhatsApp in social media mentions highlights their extensive adoption and influential presence in the Kenyan digital landscape.